One App to All Your

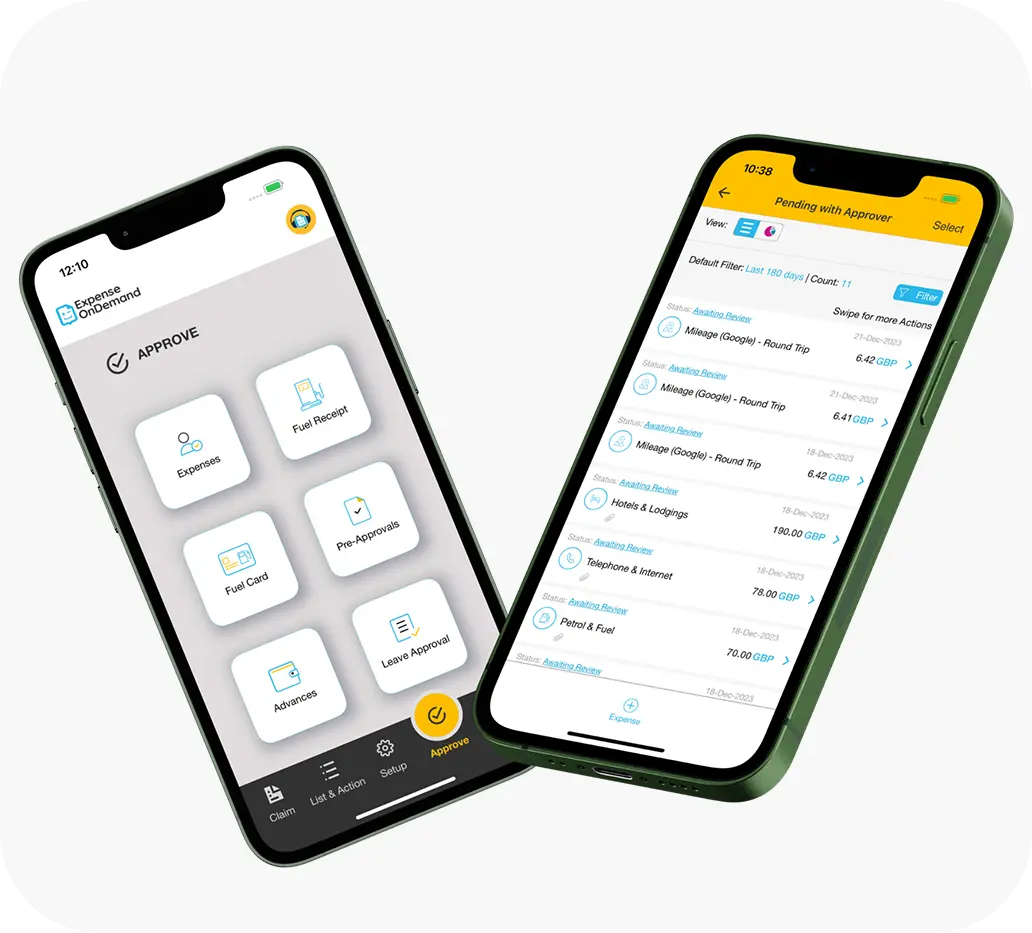

ExpenseOnDemand helps you say goodbye to spreadsheets, lost receipts & confused claimants. Say hello to on-the-go approvals, automated reports & simplified compliance.

Effortless employee expense management software & expense report app for your business.

Expense Management

Software with Free 30 day Trial

Award winning and trusted by 15,000+ companies

What Our Customers Are Saying

Why Choose

Our Expense Management

Software?

Cost-Effective

We pride ourselves on providing a substantial cost advantage over our expense management competitors.

See Our Pricing

Tailored Functionality

Customers are empowered to cherry-pick the functions they need and only pay for what they use.

Intuitive Experience

Our simple to use interface makes your interaction with the expense software seamless and enjoyable.

Support

Our acclaimed support team are ready to assist you. You can also use our chatbot to access our how-to videos.

Flexibility

Whether you're a casual or power user, our system allows you to tailor subscriptions based on usage.

Make Claimants' Lives Easier

From meals to miles, one expense management software and expense report app helps your employees claim all their expenses

Instantly snap a picture of receipts & upload to our expense tracker app

Gain complete clarity on all expenses from meals to miles

Reduce time spent to claim expenses by 95%

Simple Reporting

= New Savings

Finance teams will be able to make insightful decisions using automated expense report software

Achieve full visibility into company financial health

Effectively budget and track company spend with top rated expense report software

Automate routine tasks & sync to accounting software

Clear & Complete Audit Trail to Assure Compliance

Accurate records and audit history ensure you feel confident in compliance with the best expense management software.

Effectively control expense reporting & management with one app

Gain complete clarity on all expenses from meals to miles

Increase policy compliance & eliminate expense fraud

Check out our Customer Benefits page to understand our expense management software & report app can help you.

Reduce Mileage Expenses by 28.7%*

Eliminate the cost of estimated mileage claims

Intelligent integrations with Google Maps provide accurate mileage data from point A to point B, simplifying mileage expense tracking.

Reduce costs and eliminate admin time spent recouping overpaid travel expenses in the expense report process.

Expense Management Software: How it works

Sign Up in Less Than 2 Minutes

Claim, Approve and Pay expenses instantly

That's it! You're ready to start using ExpenseOnDemand to streamline your employee expense report process.

Start 30 Day Free TrialAn Expense Management & Report App With You Every Step of the Way

We are proud of our best in class employee expense report software, and we take great pride in being there for our customers whenever they need us.

From easy to understand pricing, where you only pay for the functionality you need, to video guides that make sure you and your team get the most out of our expense report app.

Sign up in minutes and start claiming immediately. We will get you up and running in under 5 minutes with our fully automated data importer.

Got more questions of your own? Arrange a demo of our expense report app and expense management software today.

Book a demoQuestions? We Got You!

How can I access ExpenseOnDemand?

You can access the tool through our cloud-based web portal and mobile app (available on iOS and Android).

Which currencies do you operate in?

We’re a global business that operates in over 96 countries, and counting! We currently accept payments in the following currencies: GBP, EUR, USD, CAD, AUD, INR.

Can you scan receipts?

You can snap photos of your receipts and instantly create your expense claim within seconds. This will then be automatically pushed through for approval and payment.

Do you integrate with Accounting tools?

Yes, we seamlessly sync with a number of popular accounting tools, including Xero, Sage, Tally and QuickBooks. Check out our Integrations page for more information. In the event we don’t integrate with your accounting system, you can easily create your own custom expense report using our Build-A-Report feature. We also have Open APIs for you to connect your accounting systems with us.

What are your fees?

We offer different plan tiers, each with its own set of benefits and capabilities. The cost depends on various factors, such as the specific features and functionalities you require, the size of your organisation, and the level of support and services you desire. Visit our pricing page to see our Essentials package or contact us to tailor a personalised quote that aligns with your organisation's needs and budget.

Can't find what you need? Check out our FAQs section or contact us to book a free demo!

All the expense tools you need to fully automate your employee expense reporting

Control Software Costs

Pay only for what you use. Manage expense claims software costs by using only the functions your business requires.

Mileage Tracking

You can accurately track employee mileage claims with Google Maps integration. Tracking travel expenses has never been easier.

Unlimited Reports

Get a full visualisation of your data by creating unlimited custom expense reports. You can set up your expense reporting app as you wish.

Accounting Integrations

Sync your favourite accounting software. You don't have to worry about anything else once we have synchronised your account.

Eliminate Expense Fraud

Fraudulent expense claims are prevented through smart duplicate expense recognition.

Easy Expense Approvals

You can approve expenses using the dashboard or your mobile app from anywhere. The process is simple, fast, and awesome!

Paperless Workflow

Our paperless solution can turn your finance department into an eco powerhouse. #GoGreen - Make the switch!

Super Fast Support

An intelligent AI-powered chat system in the expenses app provides super-fast support.

Best Expense Management Software for Small Business & Enterprise

Expense management software for small business, scaling startups and global enterprise companies. ExpenseOnDemand is here to help you save time with our top rated expense report app and software.

Take the demo and we’ll give you a free trial for the whole team. You decide if ExpenseOnDemand is for you with over 200 functions to choose from and flexible pricing starting from just £4.34 per user per month.

Start 30 Day Free Trial%201.png)